Accounts Receivable Tips: Get Your Customers to Pay in Time

Thursday, November 5, 2020 / Updated: November 5, 2020

One of the basic elements of business operations is the function of sending and receiving payments. These departments are usually called accounts receivable and accounts payable, respectively. The accounts receivable department is, due to its very nature, one of the core aspects of business functioning. Doing business is a process of transactions whereby a business provides a product or service and a customer pays for said product or service.

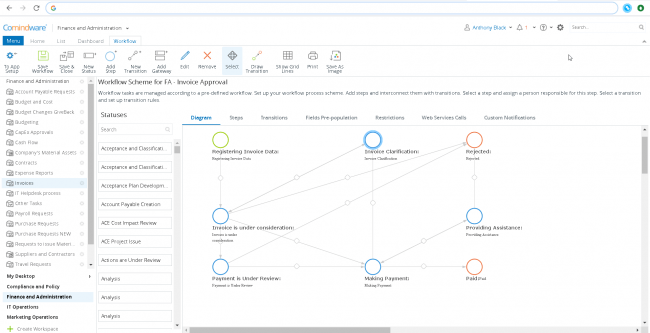

While this seems simple on its face, it can get a bit more complicated than that, especially when large or digital payments are involved. Inefficiency is often rampant in accounts receivable departments because so much is done by hand or manually entered and people have to keep track of who knows how many accounts. Managing paper invoices or even trying to manage a digital system manually leaves a lot of room for error and inefficiency. One of the ways that companies are improving this area of business is through the use of accounts receivable business process automation technology.

Ways that automation software can benefit the accounts receivable business process.

Paper invoices are still alarmingly common but that is likely to change in the future. Not only do paper copies require more in the way of physical resources for storage, but they often require people to manage, send, and file them as well. It is easy to see, especially the larger a business is, would leave open the door to error and inefficiency. This is why so many businesses are digitizing as many aspects of their business as possible since it streamlines operations, reduces time spent on manual data entry tasks, and also reduces the likelihood of human error.

There is a huge range of automation software tools that work for any and every aspect of business operations. These are so helpful and effective that many companies find that these technologies pay for themselves in a remarkably short period.

Due to the nature of the department, accounts receivable is one of the most important parts of any business. The faster and more efficiently a business can receive payment for services rendered and resolve the account, the better. This usually involves sending out payment invoices, processing payments, and resolving accounts as they are paid off. For accounts receivable, invoice processing is one of the main and most important tasks, this is how a business gets paid for the products or services they provide their customers.

Tips for improving the efficiency of the accounts receivable process.

- Simple invoicing: one problem that businesses fall prey to is putting too much information on an invoice. Invoices need to be simple and as short as possible so the customer is clear what the payment required is and when it is due. This information needs to be clearly and prominently visible. Confusing invoices can create payment delays and thus make it take longer to resolve an account.

- Accounts receivable invoice processing should have an automated reminder. Many automation software suites give you the option of sending out an email or text-based reminders to customers in advance of when their payments are due. This simple reminder can reduce the number of late payments significantly.

- Incentives to pay early or in full: many companies will provide a financial incentive to customers who resolve their accounts early or in full, rather than making payments over time. This is a great way to encourage customers to completely resolve their accounts in a more timely manner. Determining some sort of discount for early or in full payment is a great way to help resolve accounts faster and more efficiently.

- Don’t let past due accounts fester. The longer it takes to get payment from someone, the more likely it is that they won’t end up paying in full. You don’t want to keep a lot of past-due accounts active if at all possible. This means that you need to stay on top of your accounts receivable business processes to ensure that unpaid accounts aren’t slipping through the proverbial cracks. Contacting past-due customers via phone, mail, or electronic communication can be an effective way to get an overdue account resolved in a more timely fashion.

- ACH and same-day payments can make a difference when it comes to resolving accounts receivable invoice payments. This means that the money comes out of a customer’s account the same day that they pay their balance. ACH payments are payments that are automatically withdrawn from the customer’s bank account on an agreed-upon day of the month, meaning they don’t have to remember to pay their bill since it is done automatically.

In summary

An efficient and well-managed accounts receivable department is part and parcel to a successful business. It is this department that manages payments that come into the business through the sale of products and services. There is a lot of work involved in the accounts receivable process and many can be dramatically improved through the use of a workflow automation software that can send out automatic reminders to customers, clear invoices, and manage automatic payments. This software can help you resolve accounts much more quickly, with less room for error, and can also help you reduce the number of past-due accounts as well.

Posted on: in Solutions