Effective finance process management is the backbone of any successful organization. From managing day-to-day transactions to strategic financial planning, a well-defined finance business process is crucial for financial stability and growth. This article explores the key components of a strong financial function, providing insights into financial processes and procedures that can significantly improve finance processes and ultimately drive profitability.

Understanding the Core Finance Business Processes

The finance department plays a critical role in managing an organization’s financial health. The workflow of finance department includes a range of activities, all designed to ensure accurate financial reporting, effective resource allocation, and compliance with relevant regulations. But what is finance process, exactly? In simplest terms, it’s how a business manages its money.

The finance processes list is extensive, but some key finance processes are fundamental to every organization:

- Financial Reporting: Creating accurate and timely financial statements, including the balance sheet, income statement, and cash flow statement.

- Budgeting: Developing a comprehensive budget to guide financial decisions and track performance against goals. This falls within financial planning.

- Forecasting: Predicting future financial performance based on historical data and market trends. Also a component of financial planning.

- Accounting Processes: Managing day-to-day financial transactions, including journal entries and maintaining the chart of accounts. This covers everything from basic accounting to detailed financial data collection and analysis.

- Accounts Payable (AP): Managing invoices and making payments to suppliers.

- Accounts Receivable (AR): Managing customer invoices and collecting payments.

- General Ledger: Maintaining a central record of all financial transactions.

- Fixed Asset Management: Tracking and managing the organization’s fixed assets.

- Tax Compliance: Ensuring compliance with all applicable tax laws and regulations.

- Treasury Management: Managing the organization’s cash flow, investments, and debt.

- Financial Close Process: The month-end or year-end process of reconciling accounts, preparing financial statements, and closing the books.

- Revenue Recognition: Determining when and how revenue should be recognized on the income statement.

- Expense Management: Tracking and controlling expenses.

- Audit Process: Ensuring the accuracy and reliability of financial information through internal and external audits.

- Accounts Payable: Accounts payable is, for all intents and purposes, the bills that an organization must pay. This could be for products and services, to vendors, and the like. Streamlining this part of the business opens up the potential for cost savings as there are places that will provide a small amount of savings if you pay early or in full. Being able to take advantage of these perks will save the company money, which is always a positive development.

- Accounts Receivable: This aspect of financial management entails managing money that comes in. This could be in the form of basic revenue or tracking and managing outstanding bills that need to be paid by customers or vendors. You want as little lag time between sending a bill and receiving payment, so any way to streamline and improve this area of the finance department will improve efficiency and ensure timely payment.

- Payroll: Making sure your employees get paid properly and on time is a very important part of any finance department. This process needs to be straightforward and streamlined or the department will deal with regular requests for information that will take a ton of time and ultimately slow down other processes.

- Strategic Planning: This is something that tends to be done on an annual or semi-annual basis. It is where teams and management get together to think about their goals for the next year or another period of time as well as a plan for how to achieve said goals. Detailed plans of action are often created and distributed to key players in the organization and there are often regular meetings to analyze progress and discuss any potential problems or issues.

Improving Finance Processes: Efficiency and Automation

Many organizations are looking for ways to improve finance processes to increase efficiency, reduce costs, and improve accuracy. This often involves automating finance processes. What finance processes can be automated? Many, including automating financial processes and tasks within automation in finance department. Common automation targets include:

- Invoice processing in Accounts Payable (AP)

- Payment reminders and collections in Accounts Receivable (AR)

- Reconciling bank statements

- Generating reports

- Expense tracking and reimbursement

By automating finance processes, organizations can free up their finance staff to focus on more strategic activities, such as financial planning and analysis. This leads to improved finance process efficiency. Key financial processes like financial reporting can be streamlined with the right software.

Examples of Finance Process Improvement

Here are some finance process improvement examples and financial process improvement examples:

- Implementing an automated invoice processing system to reduce manual data entry and approval times.

- Using data analytics to identify trends and patterns in financial data.

- Streamlining the financial close process by automating reconciliations and report generation.

- Using cloud-based accounting software to improve accessibility and collaboration.

- Implementing a robust expense management system to track and control spending.

The Role of Technology in Finance Process Management

Technology plays a crucial role in modern finance process management. Cloud-based accounting software, enterprise resource planning (ERP) systems, and workflow automation tools can all help organizations improve finance processes. Choosing the right technology is a key step in finance process optimization and financial process optimization.

Many technology solutions can assist with process improvement in finance department and process improvement in finance function. Implementing the right software helps finance to manage process.

Internal Controls and Compliance

Maintaining strong internal controls is essential for preventing fraud and ensuring the accuracy of financial information. Financial processes and controls should be designed to minimize the risk of errors and irregularities. This often involves segregation of duties, regular reconciliations, and thorough documentation. Organizations need clear financial processes and procedures to ensure these controls are effective.

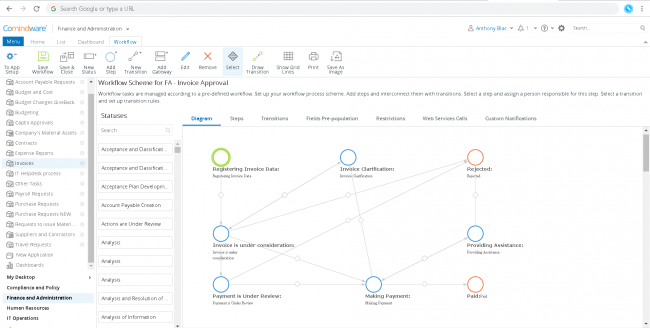

Finance Process Flow and Business Process Model

Understanding the finance process flow is crucial for identifying areas for improvement. A finance business process model provides a visual representation of the various processes within the finance department, allowing for analysis and optimization. Mapping out these financial business processes can reveal bottlenecks and inefficiencies.

Defining the Finance Process Group

A well-structured financial process group ensures clear lines of responsibility and accountability within the finance department. This team is integral to the finance process in a company and ensures the company’s financial operations run smoothly.

Financial Services Processes

Financial services processes often have unique requirements due to regulatory complexity and the need for high levels of accuracy and security. Financial process automation is particularly beneficial in this sector.

The Importance of Project Management in Finance

Finance process and project management automation helps manage the implementation of new systems, processes, and initiatives within the finance department.

Financial Workflow and Finance Workflows

A well-designed financial workflow and solid finance workflows ensure that tasks are completed efficiently and accurately. This involves defining clear roles and responsibilities, establishing timelines, and using workflow automation tools to track progress and ensure timely completion.

Looking Ahead: Continued Process Improvement

The journey to finance process efficiency is ongoing. Organizations should continuously monitor their financial processes and procedures, seek areas of improvement in finance department, and adapt to changing business needs and technological advancements.

By embracing best practices in finance process management, organizations can create a more efficient, reliable, and strategic financial function, ultimately driving greater success.